Transfer pricing is a set of rules and methods for pricing transactions between related parties, such as companies that are part of the same multinational enterprise (MNE). The goal of transfer pricing is to ensure that these transactions are priced on an arm’s length basis, i.e., as if they were conducted between independent parties.

The UAE introduced transfer pricing rules in 2023 as part of its new corporate tax regime. The transfer pricing rules in the UAE are broadly aligned with the OECD Transfer Pricing Guidelines. This means that UAE businesses can use the same transfer pricing methods and documentation requirements as businesses in other countries that follow the OECD Guidelines. Transfer pricing is an important compliance issue for UAE businesses. If a business is found to have engaged in transfer pricing arrangements that are not on an arm’s length basis, it could face financial penalties from the tax authorities.

The Importance of Transfer Pricing Documentation

If you are a business in the UAE, you should seek professional advice on transfer pricing to ensure that you are complying with the rules and avoiding penalties.

Here are some of the key things to know about transfer pricing in the UAE:

- Businesses must have a transfer pricing policy in place that sets out how they will price transactions with related parties.

- Businesses must keep documentation to support their transfer pricing policies.

- Businesses may be required to undergo a transfer pricing audit by the tax authorities.

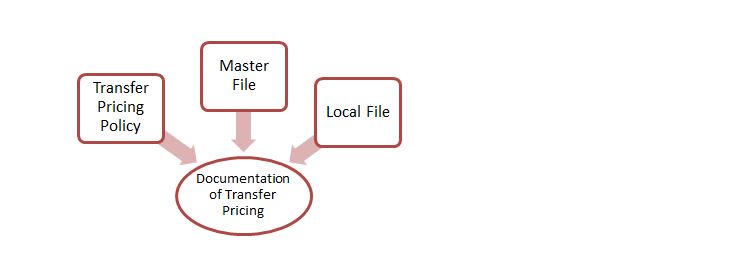

Understanding Transfer Pricing Documentation

Transfer pricing documentation is a set of documents that businesses must keep to support their transfer pricing policies. This documentation helps to ensure that the tax authorities are satisfied that the prices charged in transactions between related parties are on an arm’s length basis.

The transfer pricing documentation requirements in the UAE are set out in Ministerial Decision No. 97 of 2023 on Maintaining Transfer Pricing Documentation. The decision applies to all businesses in the UAE, regardless of their size or industry.

The required documentation includes:

- A transfer pricing policy: This document sets out the business’s transfer pricing policies and procedures. It should include a description of the business’s related party transactions, the methods that the business will use to determine arm’s length prices, and the documentation that will be kept to support the prices.

- A master file: This document provides a general overview of the business’s transfer pricing policies and practices. It should include information on the business’s group structure, its related party transactions, and the methods that it uses to determine arm’s length prices.

- A local file: This document provides more detailed information on the business’s transfer pricing policies and practices for the relevant tax period. It should include information on the specifically related party transactions that occurred during the tax period, the methods that were used to determine arm’s length prices, and the supporting documentation.

The tax authorities may request additional documentation from businesses, depending on the specific circumstances. Businesses should keep all relevant documentation in a safe and secure place for at least five years.

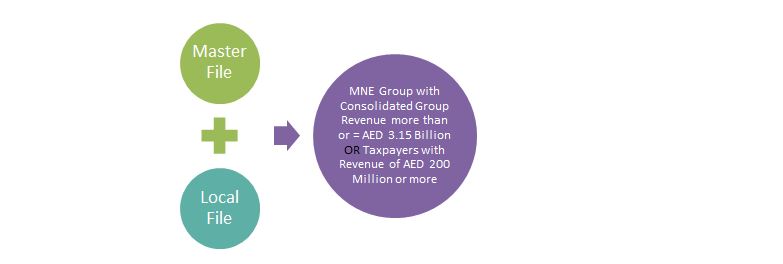

Requisites and Thresholds for Keeping a Master File and Local File

The two main types of transfer pricing documentation are the Master File and the Local File. Both files are to be maintained by entities that meet any of the below conditions:

The file must be maintained by all taxpayers who are:

- Constituent entities of a multinational enterprise group (MNE Group) with a total consolidated group revenue of AED 3.15 billion or more in the relevant tax period; or

- Taxpayers with a revenue of AED 200 million or more in the relevant tax period

The Local File

- The local file must include transactions with related parties that are non-resident entities, exempt entities, entities with a different tax rate, and entities that have made an election to be treated as small businesses.

- It excludes transactions with resident entities that are not included in the above criteria, entities with the same tax rate, individuals if parties are independent, unincorporated partnerships if parties are independent, and PEs with the same tax rate.

- Parties are considered independent if the transaction is in the ordinary course of business and the parties don’t transact exclusively with each other. Detailed instruction or comprehensive control between parties removes independent status.

- The tax authority will consider all facts and circumstances to determine the independent status of parties in a transaction.

Transfer pricing documentation is an important requirement under corporate tax UAE to ensure multinational groups properly value cross-border transactions between related parties. Without proper documentation, the UAE tax authority may adjust transfer prices, resulting in higher taxes.

AB CAPITAL Can Assist Companies in Several Ways:

In essence, thorough and well-supported transfer pricing documentation serves as a crucial tool to reduce tax liabilities and mitigate the risk of tax audits for multinational corporations operating in the UAE. The consultants at AB Capital Services boast extensive expertise in crafting transfer pricing studies tailored for UAE-based clients, aiming to aid your company in achieving compliance and effectively managing transfer pricing challenges. Our services not only encompass top-tier tax consulting but also aim to support you in maintaining an efficient tax framework.

Feel free to reach out to us today to discover further insights into how our expertise can assist you in addressing transfer pricing documentation needs and navigating other vital tax-related concerns.